February 20,2023

Following a Record 2021, M&A Still Strong for IT Businesses

Mergers and acquisitions (M&A) activity continues to serve as a significant indicator of the health and growth of our markets. M&A volumes reached record levels in 2021, with the lower-middle market deal flow particularly rising to new heights. This increase in M&A activity is a result of the COVID-19 pandemic’s impact on the global economy, with companies seeking to expand their operations and enter new markets to counteract the risk of an economic downturn. So is M&A still strong for IT businesses?

Is M&A still strong for IT businesses?

Lower-middle market M&A refers to sub $100 M transactions in total deal value, occurring between privately held companies or between a privately held business and a publicly traded company. Many of these transactions do not get the recognition that major deals get in the media, such as Microsoft’s multi-billion acquisition of Activision Blizzard. However, this is not to say lower-middle market deals are any less important.

The demand for IT businesses remains strong, driven by continued digital transformation in various industries. This demand has led to a surge in M&A activity in the technology sector, with lower-middle M&A transactions playing a significant role. It is possible that trends in alternative energy, artificial intelligence, and other significant technology developments will continue the acceleration we are experiencing. This shows M&A still strong for it businesses.

Recent M&A statistics

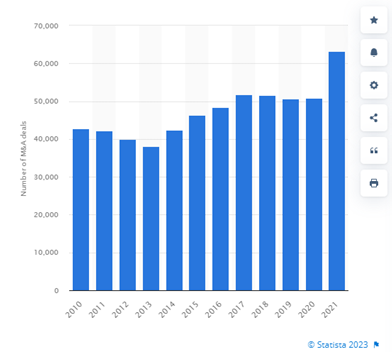

According to Statista.com here are some noteworthy statistics on M&A:

- Over 500,000 merger and acquisition (M&A) deals have been completed globally since 2010.

- 63,000 completed deals during 2021

- In 2021, M&A deal value reached approximately 5.9 trillion U.S. dollars.

Despite higher interest rates and an impending recession, demand for these small IT business deals remains strong. ITX has a global database of 55,000 buyers seeking IT-enabled businesses that allows users to simultaneously market their business to multiple interested parties.

One of the primary reasons for the increase in lower-mid market M&A activity is the need for companies to stay ahead of the changing markets. Companies in the IT space are also moving forward with higher demand across channel partners to meet their ever-changing classifications. We witnessed Microsoft challenge its partners by dropping their former status signifiers (gold, silver, bronze). With the increased adoption of technology, companies are looking for ways to differentiate themselves and remain atop the competition. This has led to a greater emphasis on acquiring technology companies and their assets, including intellectual property, customer bases, and expertise.

Business digitalization drives need

Another factor driving the demand for IT businesses is the growing need for companies to digitalize their operations. The pandemic has accelerated the digital transformation of many businesses, and as a result, there has been a surge in demand for technology companies that can help companies transition to a digital environment. More recently we have seen AI take a front seat for investments from tech giants like Google and Microsoft.

The growth in lower-mid market M&A activity is also driven by a desire for greater flexibility and confidentiality. Lower-middle market transactions are typically less formal and provide greater flexibility for both the buyer and the seller. They also provide greater confidentiality, which is important for companies that do not want to publicly announce their transactions.

The technology sector is expected to continue to be a hotbed for M&A activity in the coming years, and lower-mid-market transactions will continue playing a significant role. Companies will look for ways to expand their operations, enter new markets, and remain competitive in an ever-changing market. Note that large funds will likely target multiple smaller companies to deploy their investments rather than chase large companies due to high-interest rates and economic uncertainty.

Final thoughts

Overall, lower-mid market M&A volume in 2021 reached new heights. Now, as the volume begins to cool off, demand for IT businesses remains strong. The COVID-19 pandemic has accelerated the digital transformation of many businesses and has led to a surge in demand for technology companies. Lower-middle market M&A transactions provide greater flexibility and confidentiality, making them an attractive option for companies looking to expand their operations and enter new markets. The technology sector is expected to continue to be a hotbed of M&A activity in the coming years, and “off-radar” transactions will likely play a significant role in this activity.

Read the original article here.